Disney Visa Card: A Comprehensive Guide to Application and Benefits

Anúncios

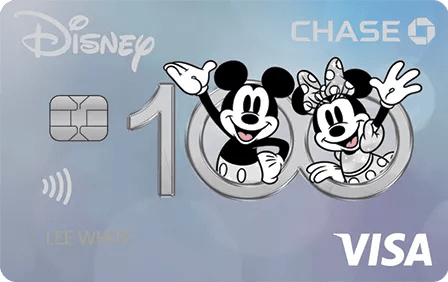

At the outset, the Disney Visa Card is introduced as a distinct fusion of Disney’s enchanting charm with the practicality of financial services. Issued by Chase Bank in the USA, this special credit card melds the realms of fun and finance seamlessly.

Tailored for admirers of Disney, it proffers a variety of perks, from price reductions on goods and dining to rewards for card usage.

Genesis of the Disney Visa Card

Originally, the creation of the Disney Visa Card stemmed from a pioneering partnership. Disney aimed to boost engagement with its brand, while Chase sought to provide unique benefits through its credit card offerings.

This collaborative effort resulted in a product that not only facilitates financial transactions but also curates unforgettable moments for its users.

Benefits of the Disney Visa Card

Rewarding System

Initially, users of the card delight in gaining rewards for their daily expenditures. Every purchase, be it at the supermarket or gas station, contributes points that can be exchanged for Disney merchandise, park tickets, or resort stays.

This system allows devoted customers to economize on Disney adventures by merely utilizing their card for everyday purchases.

Exclusive Disney Benefits

Additionally, possession of the Disney Visa Card grants access to exclusive benefits within the Disney universe.

This includes private meetings with characters at the parks, discounts on dining and merchandise at Disney locations, and priority access to special events. These privileges offer cardholders an enhanced Disney experience, blending convenience with savings.

Take a chance on other credit card options that may be exactly what you’re looking for, such as PenFed Power Cash Rewards, Blue Cash Preferred and Discover it Balance Transfer.

Merchandise Discounts

Following that, aficionados of shopping enjoy reduced prices at Disney Stores and online. This advantage permits fans to stay updated with the newest Disney merchandise, from clothing to memorabilia, without straining their budgets.

The discounts cover a wide array of products, making the magic of Disney more attainable to a broader audience.

Version with No Annual Fee

Moreover, an iteration of the Disney Visa Card exists that forgoes an annual fee. This variant ensures users can relish the perks and rewards without fretting over extra charges.

It represents an appealing choice for those desiring to accumulate Disney rewards while maintaining fiscal prudence.

Detailed Application Procedure

Prepare Required Details

Readiness is paramount. Assemble all essential personal details prior to commencing the application. This encompasses your social security number, employment status, yearly income, and contact information, facilitating a smooth application process.

Submit Your Form

Having reviewed your application and verified all details for correctness, submit your form. The submission process is generally straightforward and secure, quickly acknowledging receipt.

Patiently Wait for Approval

After submission, the approval phase commences. While instant decisions are possible, sometimes it may take several days to weeks. Be prepared for possible additional verification requests during this period.

Activate Upon Receipt

Upon approval and card receipt, follow provided instructions for activation, typically achievable online or via phone. Activation unlocks the full spectrum of benefits and rewards.

Conclusion

Ultimately, the Disney Visa Card is not merely a financial instrument; it serves as a portal to Disney’s spellbinding realm, engineered to sprinkle joy and savings across its patrons’ lives.

With its array of exclusive rewards and distinctive Disney advantages, it enriches the Disney experience for both families and enthusiasts.

Embarking on your next Disney adventure or updating your collection with the latest merchandise becomes even more magical with every swipe of your Disney Visa Card.

Dive deeper into this enchanting world by clicking the button below to uncover further details about this topic.